Tips to Speed Up Slow Paying Accounts

Profitability, Churn, & Tax Compliance: Why Subscriber Invoices Matter

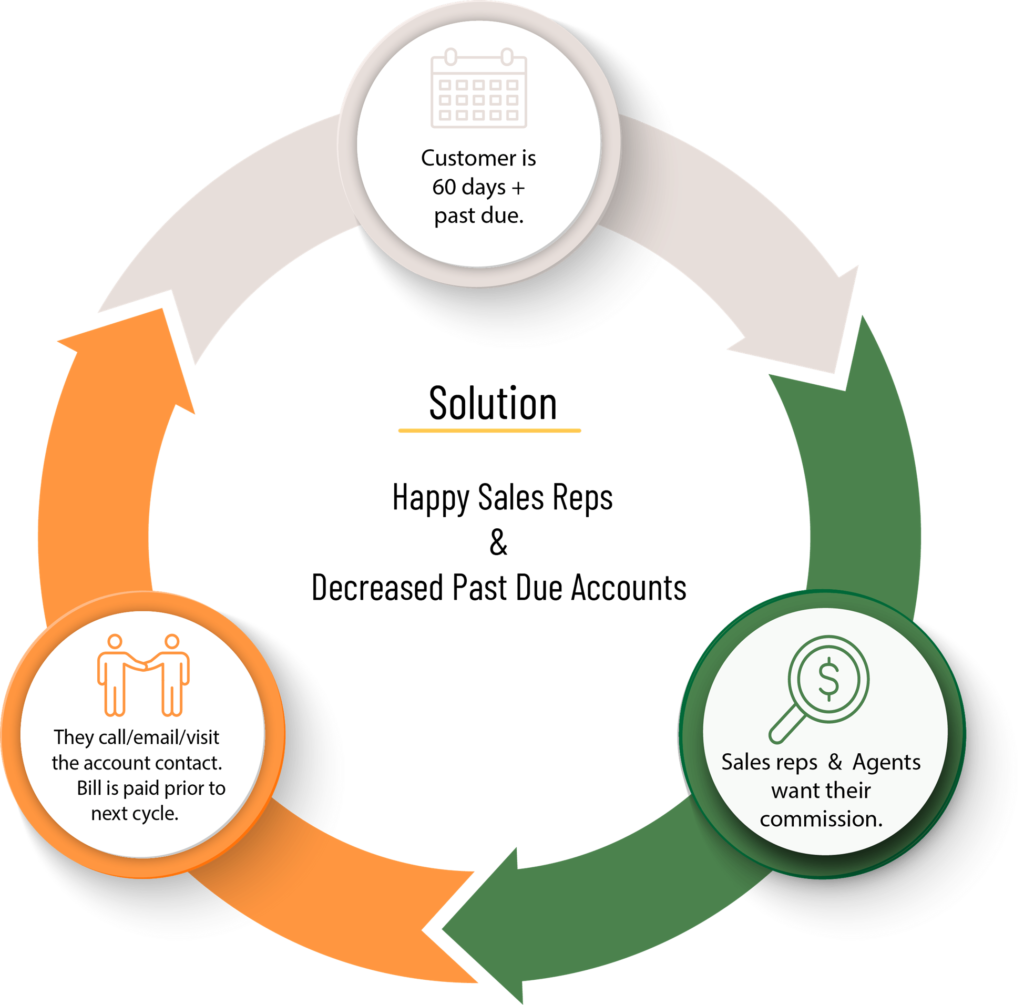

Problem: Accounts aren’t paying invoices on time (Slow Pay.)

The Agent/Sales Rep closed the sale, the customer has been provisioned and turned-up. However, the account is slow to pay. The finance charge on the bill doesn’t seem to make a difference to the account, and they always send the payment in just before or when a cut-off notice is in order. This is not a good scenario. Some of the fallout from slow paying clients includes: the time/staff drain of accounts receivable activities, inquiries from sales reps/agents about their commission payout, and cash flow impairment (potentially negatively impacting sales and installations.)

Solution: Enlist Agent’s/Sales Rep’s help with past due accounts.

What is a good way to get the invoice paid and reward the agent/sales rep for their efforts? Have them follow up with the account and ask why there has been a delay in the payment. They built a relationship with the customer in order to win their business, not the staff member who makes collection calls. The agent/sales rep can approach the account in a diplomatic way and convince them to pay the invoice. If there’s a question regarding the charges on the invoice, or perhaps the accounts payable contact has changed, the sales rep will be able to see that the matter is resolved quickly – as they are ready to receive their commission on the account. To simplify this even more - SBS’ IntegriAgent web portal enables agents/sales reps to see their paid and unpaid commissions as well as the contact information for their accounts.

Ideas to encourage on time payments:

- Offer a prompt payment discount. This can be set system-wide or on an individual account within IntegriBIll.

- Follow Up – Encourage sales reps to contact the account and re-confirm the name and contact information for the accounts payable person.

- Implement Card Not Present (CNP) payment (available in IntegriBill) so that the bill will be paid automatically without anyone having to remember to do so. The client will get a copy of the invoice and then have several days to question any charges that they might have. ACH is also an option for accounts who want to go through a bank rather than a credit card.

Improving cash flow is valuable to all businesses. So, if your billing system isn’t doing its part, contact Sandy Beaches Software today so we can discuss how we can help (800)982-6221 x3 or visit www.sandybeachessoftware.com to schedule a demo today.